uber eats tax calculator australia

The self-employment tax is very easy to calculate. For example if your taxable income after deductions is 35000 you will pay 5355 in self-employment taxes.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/15972766/IMG_4316.jpg)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

Within the gig economy its common for people to work as both ride sourcing drivers and food delivery riders.

. Find the best restaurants that deliver. The tax summary statement generated by Uber can be assessed by each driver by logging into their respective portal. We expect all of our partners to meet their tax obligations like everyone else including declaring Uber earnings in your individual tax return.

Order food online or in the Uber Eats app and support local restaurants. Driving for Uber and Uber Eats. According to our figures drivers in Australia have an average income of 3315 per hour before Uber takes.

Driver Outcome 6591. The city and state where you drive for work. Driver Output Tax Liability b 909.

Uber pays weekly which is great for you spreadsheet. Once you have received your ABN you can register for GST via the ATO. Using our Uber driver tax calculator is easy.

A The total amount received after the Service Fee is deducted. The calculator is NOT an exact estimate of your GST liability. While using the uber GST calculator Please note the following points.

According to the ATO any Australian resident must declare in your tax return all income you earned anywhere in the world during that tax year. All you need is the following information. B As the Total Fare includes GST we divide by 11 to calculate the GST amount.

If you deliver for UberEats and drive for Uber or split your time between ridesharing and food-delivery driving you will need to register for GST. This calculator is created to help uber drivers to estimate their gst and tax consequenses. UBER OLA Taxify GST and TAX calculatorThe aim of this calculator is to provide tax estimation based on your driving date and quarterly income.

Unlike Uber drivers who have different GST obligations to regular individuals food delivery drivers including UberEATS follow regular legislation and are required to register for GST once your turnover within a given 12 month period is more than 75000. A common question for Uber and Uber Eats drivers is whether car loan repayments interest or car hire costs are therefore tax-deductible. In Australia and the US Uber drivers keep just less than 75 of their weekly fare total.

If you are leasing your car to drive for Uber you can deduct the relevant portion of the lease costs proportional. Uber GST Calculator is a free tool available for Uber drivers to calculate their estimated GST. You may also be able to claim your Uber related.

The self-employment tax is very easy to calculate. The 124 percent of this tax is for Social Security and the rest 29 percent is for Medicare. Registering for GST.

Driver Net GST Liability c 659. Video by Bobby-B Music by Beastie Boys with The New StyleJust a basic tutorial explaining how I did my taxes and showing that its actually quite simple to. If you want to get extra fancy you can use advanced filters which will allow you to input.

Your average number of rides per hour. From a tax perspective this can make your taxes tricky. The average number of hours you drive per week.

Get contactless delivery for restaurant takeaway groceries and more. You simply take out 153 percent of your income and pay it towards this tax.

How Much Will I Actually Make From Uber Driving Drivetax Australia

Business Expenses For Delivery Contractors Entrecourier

Online Accounting Software Instabooks Us

Uber Driver Tax Deductions For 2022 All Your Questions Answered Wealthvisory

How Much Will I Actually Make From Uber Driving Drivetax Australia

How Much Will I Actually Make From Uber Driving Drivetax Australia

Uber Connect How To Use Pricing Availability In 2022

Business Expenses For Delivery Contractors Entrecourier

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/15972748/Screen_Shot_2019_03_19_at_1.52.15_PM.png)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

9 Concepts You Must Know To Understand Uber Eats Taxes Via Entrecourier Com In 2022 Understanding Uber Income Tax Return

How Much Will I Actually Make From Uber Driving Drivetax Australia

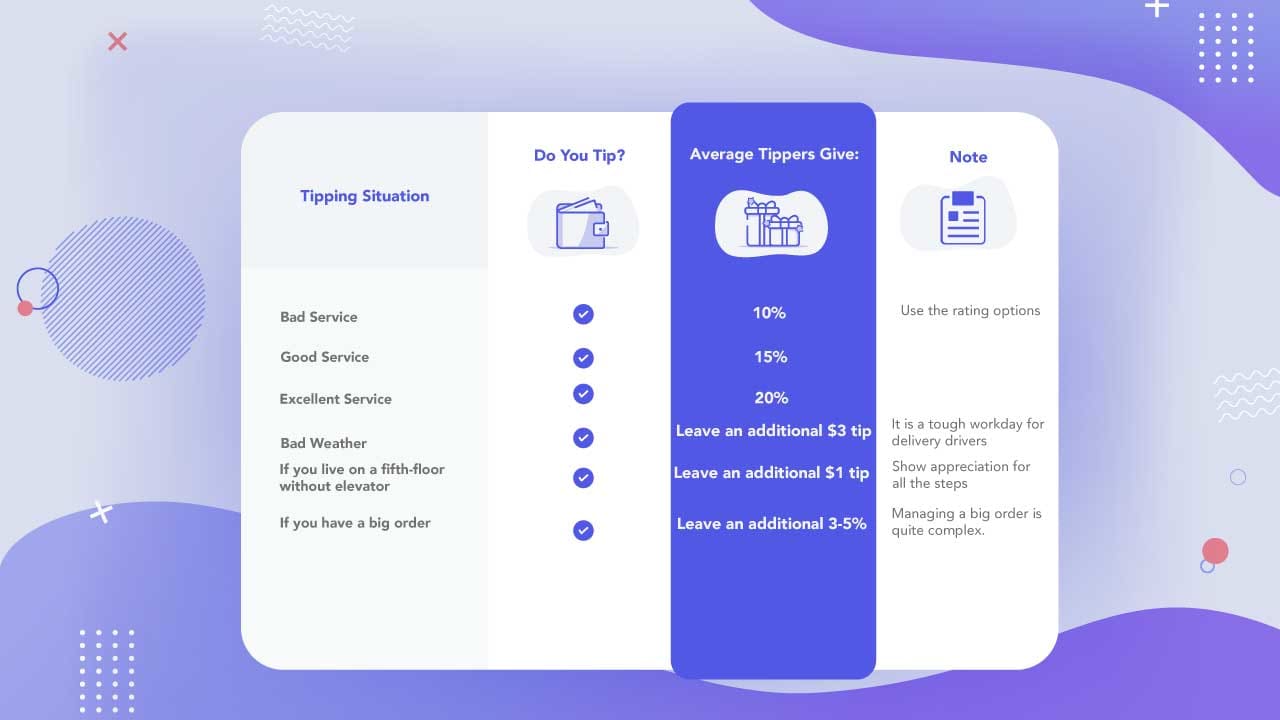

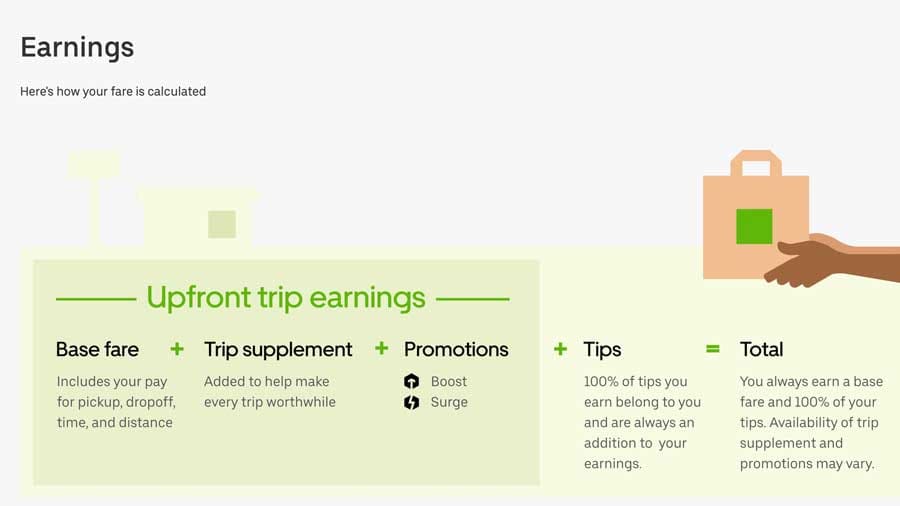

Do Uber Eats Drivers See Your Tip When You Order Food Online

How Postmates Will Help Uber Eats Turn Profitable

/cdn.vox-cdn.com/uploads/chorus_asset/file/13300243/919042992.jpg.jpg)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

Do Uber Eats Drivers See Your Tip When You Order Food Online

Uber Driver Tax Deductions For 2022 All Your Questions Answered Wealthvisory

7 Eleven Owner Brings In Former Uber Exec To Ramp Up U S Growth